About Slow Money

Invest in building an economy based on principles of soil fertility, sense of place, care of the commons, and economic, cultural and biological diversity.

Slow Money provides a meaningful alternative to our current financial system that has run amok – trillions of dollars a day flowing through capital markets in securities that no one fully understands, contributing to systemic problems of our time.

What are Slow Money investments?

Investing in real places,

in people and enterprises

close to home.

Investing patiently, over time, with a goal of building healthy enterprises, communities and ecosystems, not just extracting financial wealth.

Measuring Return on Investment by the tangible world we create around us and the health of our soil, not just the profit we make.

Northern California Leadership Team

The Slow Money Principles

I.

We must bring money back down to earth.

II.

There is such a thing as money that is too fast, companies that are too big, finance that is too complex. Therefore, we must slow our money down — not all of it, of course, but enough to matter.

III.

The 20th Century was the era of Buy Low/Sell High and Wealth Now/Philanthropy Later—what one venture capitalist called “the largest legal accumulation of wealth in history.” The 21st Century will be the era of nurture capital, built around principles of carrying capacity, care of the commons, sense of place and non-violence.

IV.

We must learn to invest as if food, farms and fertility mattered.

We must connect investors to the places where they live, creating vital relationships and new sources of capital for small food enterprises.

V.

Let us celebrate the new generation of entrepreneurs, consumers and investors who are showing the way from Making A Killing to Making a Living.

VI.

Paul Newman said, “I just happen to think that in life we need to be a little like the farmer who puts back into the soil what he takes out.”

Recognizing the wisdom of these words, let us begin rebuilding our economy from the ground up, asking:

What would the world be like if we invested 50% of our assets within 50 miles of where we live?

What if there were a new generation of companies that gave away 50% of their profits?

What if there were 50% more organic matter in our soil 50 years from now?

I’m signing the Slow Money Principles.

Please notify me about upcoming community events.

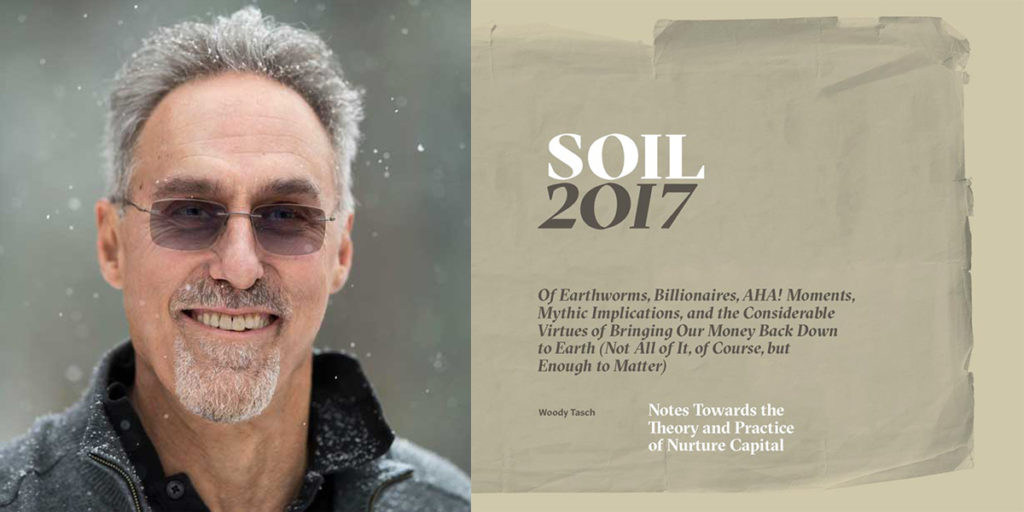

SOIL: Notes Towards the Theory and Practice of Nurture Capital

Book by Woody Tasch, founder of Slow Money [order]

Nurture capital is a vision of finance that starts where investing and philanthropy leave off, giving us a new way to reconnect to one another and places where we live, all the way down to local food systems and the soil.

Northern California Leadership Team

Angie Mertens

Co-Producer of FOOD FUNDED. Program Director at ONE WORLD Training & Investments