Inquiries into the Nature of Slow Money

a beautiful excerpt from Woody Tasch's “Inquiries into the Nature of Slow Money: investing as if food, farms and fertility mattered”:

…Let us dare to imagine an investor who has the sacred passion of an earthworm, slowly making his or her way through the soil of commerce and culture, playing a small, vital role in the maintenance of fertility.

Now, whether such notions have any practical import to the task of creating this new entity called Slow Money seems, at first, implausible. But it isn’t so. The success of Slow Money will depend upon a vision that dares to be playful; that dares to assert a connection between human and humus and humility and humor; that dares to push back against the dismal science of economics and the hegemony of market mind; that dares to put money in its place, that calms money, in much the same way that ‘traffic calming’ is becoming part of the agenda for ‘smart growth’ in progressive communities, so that healthy relationships can once again begin to flourish; that dares to put ‘taste’ and ‘flavor’ back into investing, moving from the Big Mac school of fatty and salty buy-low/sell-high investing to the Coleman Carrot school of investing that celebrates the subtle joys of terroir and authenticity.

The investor as earthworm versus the investor as Master of the Universe.

For my part, I would rather emulate an earthworm than an astronaut. I would rather enrich a plot of land than grow the portfolio of a quant.

Does this make me a bad investor? No, it makes me a different kind of investor. I would argue that an investor whose financial activity is predicated upon extraction—upon the linear take-make-waste methodologies of a world that had never seen the picture of the earth rising over the moon—is not really an investor at all. He is not truly investing himself in that to which he is applying his capital. Quite the opposite. He is keeping himself completely out of it, denying any personal connection to or responsibility for that to which his capital is lending its energy. How is it that something that is all about exists and liquidity and anonymity can really be called, in good faith, investing at all?

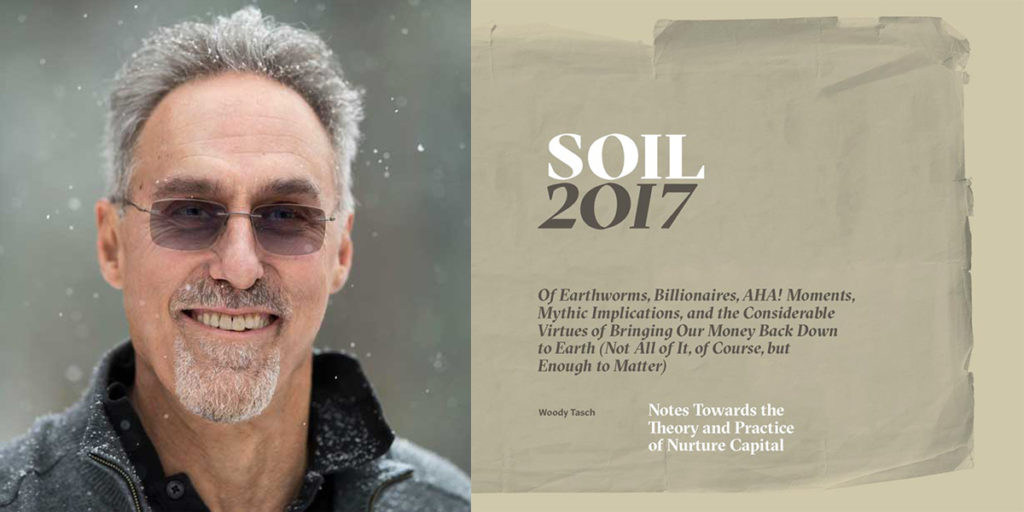

SOIL

Notes Towards the Theory and Practice of Nurture Capital

Recent book by Woody Tasch, founder of Slow Money [order]

Nurture capital is a vision of finance that starts where investing and philanthropy leave off, giving us a new way to reconnect to one another and places where we live, all the way down to local food systems and the soil.