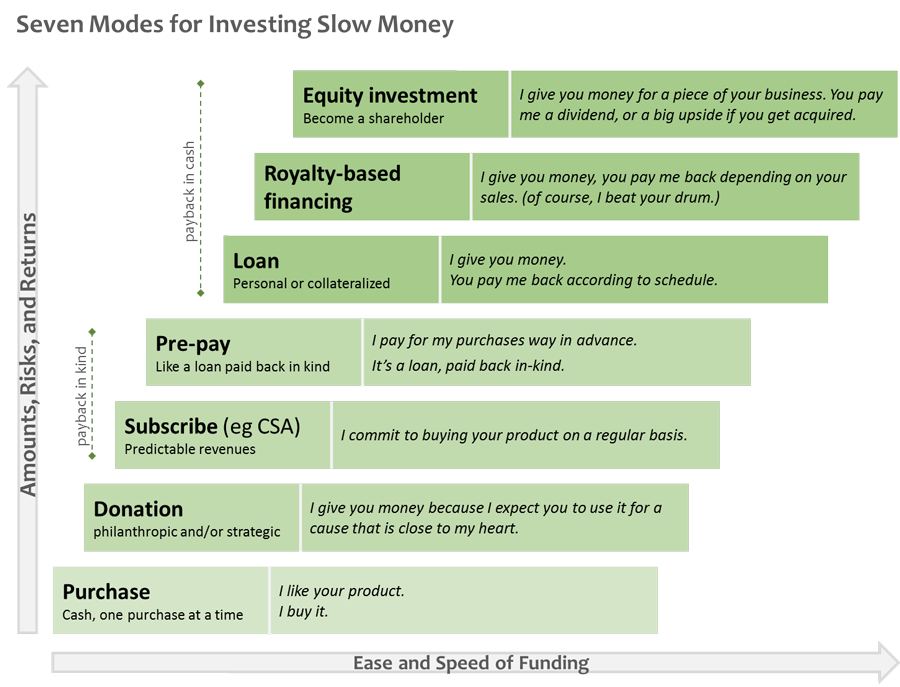

Seven ways to invest Slow Money in food businesses

You decided to find a better place for your money? How to bring money back down to earth?

Slow Money investors have used various mechanisms to put money into sustainable food businesses. Here is a (grossly simplified) overview about the seven main “modes”:

Purchase

Support a business one purchase at a time. (no up-front funding, though)

Best for: any retail business

“I like your product. I buy it”

One-off example: any shop or restaurant (we all do it all the time)

Aggregation example: Good Eggs

Subscribe (e.g. CSA)

Predictable revenues for the business, month by month

Best for: customers with steady lifestyles

I commit to buying your product on a regular basis.

One-off example: CSA for your favorite farm

Aggregation example: Local Harvest

Pre-pay

Somewhat like a loan repaid in-kind with products

Best for: businesses seeking to grow our upgrade

“I pay for my purchases way in advance.”

One-off example: gift certificate

Aggregation tool: Credibles

Loan

Personal loan to entrepreneur or collateralized loan to business

Best for: for businesses with reliable revenues

“I give you money. You pay me back according to schedule.”

One-off tool: Promissory Note

Aggregation example: RSF Social Finance, Kiva

Royalty-based financing (often called Revenue-Share)

Loan or Equity with pay-back rates depending on revenues

Best for: for businesses with expected growth

“I give you money, you pay me back depending how you’re growing. (of course, I’ll beat your drum.)”

One-off tool: Royalty Note

Equity investment

Purchasing a share in the business (often a Convertible Note that turns into equity in the future)

Best for: startups

“I give you money for a piece of your business. You pay me a dividend based on your profits. I could get an upside, if you happen to get acquired.”

One-off tool: angel investment, self-directed IRA

Aggregation tool: investment groups; watch for crowdfunding platforms in 2013

These seven investment modes (I have personally used all of them) get increasingly more complex, in the order listed. Slow Money investing is best done as a team sport. You’re invited to join like-minded investors at our meetings.